Split Payments vs. Point-of-Sale Lending: Behind the Hype at Checkout

Once, credit at checkout was a straightforward affair: a single approval, a preset limit, and revenue earned through interchange. Fast forward to today, and the landscape has fractured into competing models, both promising seamless financing at the point of purchase. FinTech tout “instant instalments,” but behind the buzz are two dominant approaches: split-payment card instalments and point-of-sale (POS) lending, also known as buy now, pay later (BNPL).

These models aren’t interchangeable. They differ in structure, economics, and how they distribute risk. Understanding where each model fits isn’t just smart, it’s essential for lenders aiming to capture new volume while managing exposure.

What’s the Difference?

- Split Payments - Think of these as card-based instalment plans. The consumer’s existing credit line (provided by a lender, operating via their cards (e.g., Visa, MasterCard, Discover, or a private-label store card) is carved into three, six, or twelve equal payments at checkout. Authorisation still relies on traditional card rails - simply alter the payback cadence changes. Risk stays largely where it’s always lived on the card issuer’s balance sheet, making this a familiar beast, but there is risk to the retailer that recurring payment authorisation can be removed at any time.

- POS Lending / BNPL - Here, a third-party financing firm issues a new micro-term loan at checkout, a closed-end instalment contract or pay-in-four, typically 0% APR, for the consumer, with the retailer paying a discount rate. Funds flow off-card, underwriting is real-time, and repayment comes via either direct debit or recurring payment authorisation on file. Retailers receive funding from the finance provider, removing their risk, but there is a cost associated with this, pre-agreed with the finance firm (typically, a percentage).

Demand Is Real - User Bases Are Different

Split-pay adoption has quietly outpaced the flashier BNPL headlines. A 2024 PYMNTs survey found that around six in ten of the surveyed U.S. consumers had used some form of split payment in the past year, with Millennials leading the charge at 72%. Everyone already carries a card, and the issuer relationship is baked in, meaning that this is a ready-made relationship.

BNPL, meanwhile, has hockey stick-like growth. Global GMV hit $9.5 billion in November 2024 alone, the highest month on record.

McKinsey pegs POS financing as one of the fastest-growing segments in consumer credit, driven by digital-first merchants and pandemic-era adoption.

Both products have demand, and the user bases only partially overlap. Ignoring either the cohort or a retailer risks leaving money on the table.

Lender Edge with Split Payments

- You Understand Risk - Your consumer customer is inside your card portfolio already, so no new CDD uplift, no fresh regulatory filings, and fraud tools are battle-tested.

- Interchange plus Fee Income - Card issuers can add-on a fixed instalment setup fee or a marginally higher APR: adding that to existing card economics means that net interest margin (NIM) per account can increase.

- Lower Charge-Offs - Card instalment losses track overall revolvers and are both predictable and granular: if a specific instalment defaults, the card issuer remains within the card line credit metrics.

- Merchant Adoption is Straightforward - Processors can simply flip the “instalment” flag in their processing technology, and there is no need for messy integrations and no dual pricing. Acquirer surveys show 74 % believe store-card split-pay plans boost merchant satisfaction.

- Regulatory Familiarity – CFPB know card regulations and split payments do not trigger separate loan disclosure regimes, so compliance teams sleep easier.

Lender Edge with POS Lending / BNPL

- Bigger Tickets, Greater Merchant Fees - BNPL tickets run 2-4x greater than debit transactions, and merchants gladly trade 3–8 % in discount for 30 % larger carts. That fee flows to you, not the networks.

- New Customer Acquisition – Lending is not limited to your cardholder base. Every POS approval drops a new credit-qualified consumer into your funnel for upsell to other products.

- Data - Real-time transactional data at (e.g.) SKU, merchant (MCC), device can feed advanced credit risk models. Analytics firms like EXL flag this as critical to building “risk frameworks purpose-built to scale POS financing”.

- Diversified Asset Class - Short-duration, fixed-rate BNPL offsets longer-duration card books. For ALM teams and CFOs, that’s very useful in reducing the risks of liquidity mismatch.

- Brand Visibility - Consumers meet you at the happy moment of purchase, not a dry application form. That top-of-mind awareness can’t be bought with banner ads.

Caveats - and They’re Not Small

- Regulatory overhang - Split payment as a method may feel safe today, but both U.S. and U.K. regulators are considering APR disclosure on deferred-interest offers. BNPL already faces proposed reporting rules and potential inclusion under Truth-in-Lending. Either way, compliance spending is going up, not down.

- Credit risk blind spots - BNPL underwriting based on soft-pulls or proprietary data works, until macro turns. Holiday-driven surges in BNPL volume (Cyber Monday 2024 saw usage leap 27 % YoY) look great until charge-offs roll in. Tight monitoring and swift amendment to risk-based pricing are mandatory.

- Merchant concentration risk - A few enormous retailers may represent outsized BNPL exposure. Lose one partnership (due to, for example, a retailer going out of business), and your origination pipeline can take a real blow.

- Consumer fatigue - Klarna may process 2.9 million daily transactions, but repeat borrowing can spark delinquency spikes, and thus regulators are expected to sharply scrutinise affordability assessment in future.

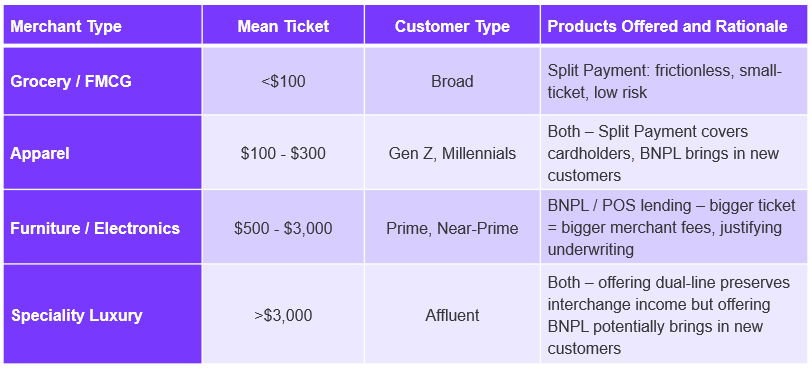

Decision Grid: When to Lead with Which Product

Operational Deployment

- Are you a Card Issuer? Yes? Start with Split Pay - It’s the lowest-hanging fruit. Add simple APIs to your existing transaction authorisation flow and get live within weeks. Pilot with loyal merchant partners before a wider roll-out.

- Layer BNPL selectively - Target verticals where APR is a deal-maker, not a deal-breaker. Build or buy a real-time credit engine capable of sub-second decisions, especially given that credit-hungry customers typically won’t wait.

- Integrate Repayment Data into Bureau Data - Reporting positive performance protects you when regulators demand it and helps consumers build their credit histories and, in the US, FICO and VantageScores.

- Offer Merchants a Single Integration - Letting them toggle split pay and BNPL in the dashboard based on the consumers’ preference. Simply, the less code they touch, the stickier your relationship.

- Sharpen Risk Governance - Use adaptive credit limits, dynamic discount rates, and real-time fraud scoring: having a simple monthly scorecard review based on RAG simply won’t be sufficient, especially given the potential for enormous portfolio growth in very little time.

Winning the Instalment Game Means Playing Both Sides

You don’t have to bet it all on one model. Split payments offer a fast track to growth by using your existing credit rails, compliance frameworks, and issuer data. POS lending unlocks new segments, richer data streams, and greater fee potential. When deployed side by side and tailored to merchant category and ticket size, the combination becomes a powerful engine for acquisition and yield.

The market will evolve. Regulators will intervene. Consumers will shift behaviour. That’s the nature of credit. But by running both playbooks with precision and agility, lenders can own more of the checkout moment and make each one count.

Curious how this ties into embedded lending? Read more