Payment Aggregator

What is a Payment Aggregator?

A payment aggregator is a service provider that enables merchants to accept online payments without setting up their own individual merchant accounts with each acquiring bank. Also known as a merchant aggregator, this model simplifies the onboarding process for businesses by allowing multiple merchants to operate under a single master merchant account.

Payment aggregators facilitate digital transactions by collecting payments on behalf of various merchants, then transferring the funds to the individual businesses after processing. This model has become especially popular among small to mid-sized businesses and e-commerce platforms that seek quick integration and lower operational overhead.

The aggregator payment model is widely used in online retail, subscription services, marketplaces, and other digital commerce settings.

How Online Payment Aggregators Work

Online payment aggregators act as intermediaries between the merchant, the customer, and the financial institutions involved in processing the payment. Here is a step-by-step overview of how the process typically works:

- Merchant Onboarding: The aggregator conducts due diligence and enables the business to accept payments under its umbrella account. This process is generally faster and less complex than setting up a dedicated merchant account.

- Payment Acceptance: When a customer initiates a transaction, the aggregator handles the front-end payment processing, including integration with payment gateways and customer verification.

- Transaction Processing: The aggregator works with acquiring banks and card networks to authorize, clear, and settle the transaction.

- Fund Disbursement: Once the payment is processed, the aggregator deducts applicable fees and disburses the remaining funds to the merchant, usually within a few business days.

- Reconciliation and Reporting: Aggregators provide merchants with dashboards and tools to track transactions, generate reports, and manage refunds or disputes.

Online payment aggregators often support multiple payment methods, including credit and debit cards, digital wallets, bank transfers, and newer models such as Buy Now Pay Later (BNPL). For more on consumer financing options at checkout, see our entry on Checkout Financing.

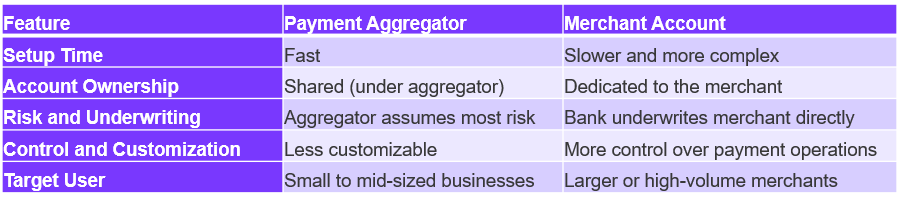

Payment Aggregator vs. Merchant Account

The key difference between a payment aggregator and a traditional merchant account lies in how payment relationships are structured and managed.

While merchant accounts provide greater control and are better suited to enterprises with large transaction volumes or specific compliance needs, payment aggregators are ideal for businesses seeking speed, flexibility, and a simplified path to accepting payments.

Benefits of Using a Merchant Aggregator

Businesses that use a payment aggregator benefit from several operational and financial advantages:

- Simplified Onboarding: No need to negotiate individual agreements with acquiring banks or payment processors.

- Faster Time to Market: Businesses can start accepting payments quickly, often within days.

- Access to Multiple Payment Methods: Aggregators support a variety of local and international payment options.

- Reduced Compliance Burden: Aggregators handle much of the risk management, security, and regulatory compliance.

- Built-in Tools: Many platforms offer dashboards, analytics, chargeback handling, and reconciliation tools.

This model is especially beneficial for platforms that host multiple vendors or sellers, such as online marketplaces, SaaS platforms, or gig economy platforms.

Considerations and Limitations

While payment aggregators offer significant convenience, there are some trade-offs to consider:

- Control Over Settlement Times: Aggregators determine when funds are disbursed, which may vary.

- Dispute Management: The aggregator acts as an intermediary in case of chargebacks, which can slow resolution.

- Fee Structures: Aggregator fees may be higher compared to those negotiated through direct merchant accounts, especially for high-volume businesses.

- Risk of Platform Restrictions: Aggregators may impose limits or suspend accounts if unusual activity is detected.

Before choosing a payment aggregator, businesses should assess their transaction volumes, risk exposure, and long-term growth plans.

Use Cases in Embedded Finance

Payment aggregators are often integral to Embedded Payments models, where financial services are delivered directly within digital platforms. By simplifying payment acceptance, they allow non-financial companies to offer seamless transactions without developing in-house infrastructure.

This model aligns closely with embedded lending, BNPL for Business, and other integrated financial services.

Conclusion

A payment aggregator provides a streamlined, flexible way for businesses to accept online payments without the complexity of traditional merchant accounts. This model has become a key enabler of digital commerce and embedded finance, particularly for small businesses and platforms with distributed sellers.

By understanding the advantages and limitations of the aggregator model, businesses can make informed decisions about how to manage payments while focusing on growth, efficiency, and customer experience.