Neobank

What is a Neobank?

A neobank is a type of financial institution that operates entirely online without a physical branch network. Sometimes referred to as digital-only banks or challenger banks, neobanks offer a range of financial services through mobile apps or web platforms. These services typically include current accounts, savings products, money transfers, payment processing, and in some cases, lending and budgeting tools.

The term "neobank" distinguishes these fully digital institutions from traditional banks that operate brick-and-mortar branches. Most neobanks are built from the ground up using modern infrastructure and focus on user-friendly interfaces, low fees, and fast onboarding processes.

While some neobanks hold their own banking licenses, others operate in partnership with licensed banks or use Banking as a Service (BaaS) platforms to deliver regulated financial products.

How Neobanking Works

Neobanks are designed to be accessed entirely through digital devices such as smartphones and computers. Customers can open accounts, make payments, track spending, or access financial products through mobile apps or online dashboards without visiting a physical branch.

Neobanking platforms typically rely on modern, cloud-based core banking systems and APIs to integrate various services such as:

- Customer onboarding and identity verification

- Account and payment management

- Integration with third-party financial services

- Real-time transaction monitoring

- Customer support through digital channels

Some neobanks develop proprietary technology in-house, while others use fintech infrastructure providers to accelerate time to market. Regardless of the approach, the core objective remains the same: to deliver fast, accessible, and transparent banking services through digital interfaces.

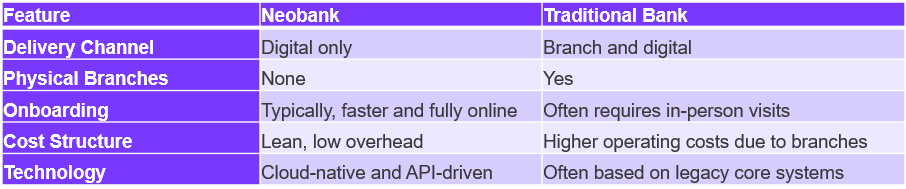

Neobank vs. Traditional Banks

The primary distinction between a neobank and a traditional bank is the delivery model. Neobanks are digital-native and operate without physical locations, while traditional banks have branch networks and legacy systems.

Although traditional banks offer digital services, their infrastructure and regulatory obligations are often more complex. Neobanks, on the other hand, can experiment with product design, customer experience, and fee models more freely.

The Role of Neobanks in Digital Finance

Neobanks have played a major role in advancing digital finance by providing an alternative to conventional banking models. Their customer-centric approach, combined with low fees and intuitive design, has attracted both retail consumers and small businesses.

Some common ways neobanks contribute to the digital financial ecosystem include:

- Financial inclusion: Serving underbanked populations or individuals who do not meet traditional credit or documentation requirements

- SME banking: Offering digital-first business accounts with features like invoicing, cash flow management, and real-time payments

- Personal finance tools: Helping customers manage budgets, categorize expenses, and receive insights into their spending patterns

- Embedded finance: Partnering with other digital platforms to offer integrated banking products at the point of need

Neobanks also contribute to the broader fintech ecosystem by encouraging innovation in areas such as Digital Lending, Fintech Lending, and real-time payments.

Conclusion

Neobanks have redefined how banking services are delivered and experienced. With a fully digital infrastructure and a focus on usability, transparency, and accessibility, they continue to challenge traditional financial institutions and influence the direction of fintech innovation.

Whether operating under their own license or through BaaS partnerships, neobanks play a growing role in expanding access to modern financial services for consumers and businesses alike.